Youth Share Certificate | Youth Savings | Youth Checking

Secure Your Child's Future with an Austin Telco True Youth Share Certificate!

Designed specifically for young savers, our certificate offers a fixed rate and the flexibility to make additional deposits over time. This unique learning platform mimics an adult account, teaching your child money management principles. The True Youth Share Certificates also instill the value of patience and disciplined saving, fundamental skills for lifelong financial success.

Benefits

-

A $25 minimum starting deposit

-

Allows additional deposits of $25 or more

-

Dividends are paid monthly

-

Designed for those under 18 years old to learn about saving and investing

-

Better returns than savings accounts

True Youth Share Certificate Accounts

Share Certificate Rates - Effective as of January 1st, 2026

$25 to $5,000

| Term | Dividend Rate | Annual Percentage Yield |

|---|---|---|

| 12 mo. | 3.65% | 3.65% |

- A minimum deposit of $25 is required

- Dividends are paid monthly to the membership savings account

- No monthly account/service fees

- Funds must remain on deposit for the term of the certificate or penalties will apply as follows:

- 1. Terms of 12 months or less - 90 days dividends

- 1. Terms of 12 months or less - 90 days dividends

- Please see Fee Schedule

- Fees could reduce the earnings on the account

- Rates subject to change without notice

- One youth share certificate allowed per child's social security number

- The True Youth Share Certificate, upon maturity of the account if the account holder has reached eighteen (18) years of age, the account will close and funds will be transferred to the Membership Savings account

Opening a True Youth Share Certificate

Our True Youth Share Certificate account can be opened at any of our lobby locations and will require a True Youth Savings Account.

Don't have a True Youth Savings Account? You'll need the following:

- If the child is 16 or older, they must have a government issued ID.

- Child's Social Security Number

- Adult 18 years old or older as a joint owner, with their government-issued ID and Social Security Number.

- $5 deposit required to remain in the True Youth Savings Account as their share of the credit union for as long as the account is open

Fostering Lifelong Financial Habits with an Austin Telco Savings Account

Invest in your child's future with a True Youth Savings Account, designed to foster financial understanding from a young age. Our True Youth Savings Account helps teach children and teenagers the basics of banking, money management, and financial responsibility. We offer youth savings accounts with no monthly service fees. Easily opened with any adult 18 years or older as a joint owner, this account comes with the benefit of online and mobile banking for easy monitoring of balances and transactions. Start today and empower your child with lifelong financial habits and the tools for success with a True Youth Savings Account.

Savings - Anticipated Dividends

Effective as of January 1st, 2026

Truth-in-Savings Share Disclosure

| Balance | Dividend Rate | Annual Percentage Yield |

|---|---|---|

| Below $100 | 0.00% | 0.00% |

| $100 and above | 0.10% | 0.10% |

- A minimum deposit of $5 must be maintained

- No monthly account/service fee

- An average daily balance of $100 is required to obtain the Annual Percentage Yield for the monthly dividend period

- Dividends are compounded and paid monthly

- Accounts are still subject to the Fee Schedule

- Fees could reduce the earnings on the account

- Rates subject to change without notice

Account Opening Requirements

Opening a Savings Account can only be done at one of our full service branches. You'll need the following:

- If the child is 16 or older, they must have a government issued ID.

- Child's Social Security Number

- Adult 18 years old or older as a joint owner, with their government-issued ID and Social Security Number.

- $5 deposit required to remain in the Savings Account as their share of the credit union for as long as the account is open

Empower the Next Generation with a True Youth Checking Account and Debit Card

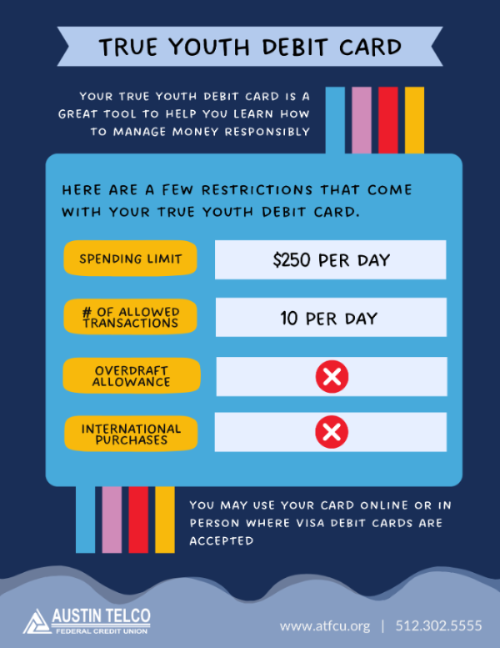

Teach your kids how to be mindful of their finances with a True Youth Checking Account and Debit Card. Tailored specifically for the younger generation, this solution provides a secure debit card experience, blending the features of our regular debit cards with enhanced protection and oversight.

The True Youth debit card ensures safe spending by setting daily limits, capping daily transactions, not allowing an overdraft allowance, and declining international purchases. Parents can easily set up account alerts via our Online or Mobile Banking platforms for added peace of mind. This ensures you remain in the loop about your child's spending, guaranteeing their hard-earned money remains protected.

True Youth Debit Card

- Spending Limits: $250 Per Day

- Number of Allowed Transactions: 10 Per Day

- No International Purchases

- No Overdraft Allowance

.png)

Opening a True Youth Checking Account

Our True Youth Checking account can be opened at any of our lobby locations and will require a True Youth Savings Account.

Don't have a True Youth Savings Account? You'll need the following:

- If the child is 16 or older, they must have a government issued ID.

- Child's Social Security Number

- Adult 18 years old or older as a joint owner, with their government-issued ID and Social Security Number.

- $5 deposit required to remain in the True Youth Savings Account as their share of the credit union for as long as the account is open