Earnings that are almost too good to be true.

Why just use your checking account when you can earn from it? With True Earnings Checking, you’ll enjoy all the freedom of our Free Checking account plus the opportunity to earn up to 5.00% APY on your balance. It’s simple: just meet a few easy qualifications each month, and your everyday banking turns into real rewards.

- Earn 5.00% APY4 on balances up to $15,000

-

No monthly fees and no minimum balance required

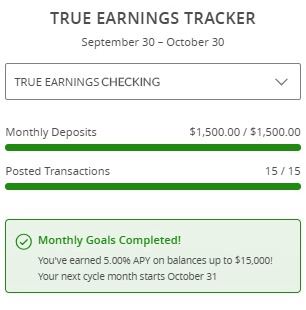

- Track your progress to earning using the True Earnings Dashboard available in Digital Banking

How to Earn 5.00% APY

-

Deposit at least $1,500 in new money (direct deposit, check, cash, etc.)2

-

Make 15 debit card purchases that post and settle during the month3

-

Open with a $150 minimum deposit

If you don’t meet the qualifications for the month, no worries, you’ll still earn 0.05% APY if you have an average daily balance of $1,500 and can qualify again the next month.5

Already a member? Log in to Digital Banking or call us during regular business hours to set up your True Earnings Checking account.

| Advantage | Fee |

|---|---|

| Monthly Service Charge |

$0

|

| Minimum Daily Balance | $0 |

| Per Check Charge | $0 |

| Customer Services | Local |

| Online Banking | Free |

| Mobile Banking | Free |

| Bill Pay | Free |

| Dividends | 5.00% up to $15,000 |

| Account Alerts | Free |

| Visa Debit Card | Free |

| Mobile Deposit | Free |

| ATMs in Network | 300+ Free |

Truth-in-Savings Share Disclosure

1For True Earnings Checking accounts, you may qualify for a higher annual percentage yield if you meet the applicable minimum eligibility requirements for the Cycle Month.

To meet the minimum eligibility requirements, you must:

a) deposit a minimum of $1,500 in New Money;

b) complete 15 qualifying debit card transactions; and

c) complete a $150 minimum opening deposit.

The Cycle Month is defined as the last day of the calendar month to the day before the last day of the following calendar month (e.g., April 30 to May 30).

2New Money is defined as deposits made through the Automated Clearing House (ACH) network, cash, checks, electronic transfer, payroll, pension, government benefits (such as Social Security), or other regular income by a member’s employer, the government, or an outside agency, or deposits made via card. Internal transfers from a current credit union account where you are a primary or joint owner do not qualify. New Money deposits must post and settle to your True Earnings Checking account during the Cycle Month to qualify.

3The 15 qualifying debit card transactions must post and settle on your True Earnings Checking account during the Cycle Month to qualify. Pending transactions do not qualify. Transactions may take one or more business days to post and settle. Automated teller machine (“ATM”) transactions do not qualify as a debit card transaction and do not count toward Eligibility Requirements.

4If you meet the minimum eligibility requirements during the Cycle Month, the first dividend rate and annual percentage yield listed for this account in the Rate Schedule will apply if your balance is $.01 to $15,000.00.

If you meet the minimum eligibility requirements during the Cycle Month, the second dividend rate and annual percentage yield listed for this account in the Rate Schedule will apply if your balance is $15,000.01 or greater.

Each Dividend rate will apply only to that portion of the account balance within each balance range.

5If you do not meet all the minimum eligibility requirements during the Cycle Month; however, you maintain an average daily balance of $1,500.00, the third dividend rate and annual percentage yield listed for this account in the Rate Schedule will apply to your entire balance.

Open to eligible account types.