June 13, 2024

External Transfer Service - Introducing Plaid

We are excited to announce the release of our new and enhanced external transfer service, now featuring instant verification through Plaid! This update is designed to provide you with a faster, more secure banking experience.

To take full advantage of these new features, please log in and verify that your external accounts are linked. If you need a list of active external accounts, please send us a secure message through our new digital banking platform. You will then need to re-establish any one time or re-occurring payments you previously had. Below is a helpful guide video on how to link external accounts in the new system.

June 5, 2024

Important Security Reminder: Protect Your Secure Access Code (SAC)

As we prepare to launch our new Digital Banking platform, we want to ensure your account security is top priority. One crucial aspect of this security is the Secure Access Code.

What is a Secure Access Code?

A Secure Access Code is a unique one-time use code sent via text message or call to the phone number we have on file for your account. This code is your key to accessing our new Digital Banking services.

Why is the Secure Access Code Sent via Text or Call?

We send the Secure Access Code exclusively through a text message or phone call to enhance security. Text messaging and phone calls are more secure than email, which can be vulnerable to interception and phishing attacks. By using a text message or phone call, we ensure that your Secure Access Code reaches you directly and securely.

Keep Your Secure Access Code Confidential

To protect your account and personal information, it is vital that you do not share your Secure Access Code with anyone. Austin Telco will never contact you asking for your Secure Access Code. If you receive such a request, it is a fraudulent attempt to gain access to your account. Hang up or don't respond to the text and reach out to us directly.

Remember:

- Do not share your Secure Access Code with anyone.

- Austin Telco will never ask for your Secure Access Code.

- Keep your phone number updated with us to ensure you receive your Secure Access Code.

Your security is our top priority. Thank you for helping us keep your account safe and secure.

June 3, 2024

Important Dates and Times Regarding Online Banking

As we prepare for the launch of the new Digital Banking Platform there are a few dates and times to keep in mind.

Thursday, June 6th at 6:00PM CDT

- External Transfers to Outside Financial Institutions (FI to FI) and Bill Pay will be unavailable starting at 6:00 PM CDT until the launch of our new Digital Banking platform on June 11th.

Friday, June 7th at 6:00PM CDT

- Online Banking and the Mobile Banking App will be unavailable starting at 6:00 PM CDT and will remain inaccessible until June 11th.

May 28, 2024

Important Payee and Payment Notice for Bill Pay Users

As we gear up for the exciting Bill Pay Upgrade accompanying our upcoming Digital Banking Platform, please note that adding new payees to your account will be temporarily disabled from June 3rd through June 10th. Additionally, payments will not be processed between June 7th and June 10th. Any scheduled payments during this period will be processed on June 11th or can be rescheduled before June 7th. We appreciate your cooperation and understanding during this transition.

May 21, 2024

New Digital Banking System - Launching June 11th

Austin Telco FCU is getting ready to upgrade your digital banking experience. We want to make your transition to our new digital banking system as smooth as possible.

Here's how you can prepare for the switch:

-

Retrieve your username before June 7th - The new system will only allow you to use your username to log in (your password will remain the same).

-

Update your mobile number and email address (All primary and joint members should update their contact information in order to receive a Secure Access Code during enrollment).

-

Complete online banking and mobile app transactions by June 6th.

-

Download/Update the mobile app on June 11th - Be prepared for the new mobile app to use a little more space than the old app. You will need to manually update the app if your app store is not set to automatically update.

-

If you are an Intuit product user, a data file backup and a final transaction download should be completed by June 6th.

-

Visit our FAQ Page to find important updates you may have missed.

Online and Mobile Banking Outage June 7th - June 10th

Our online banking and mobile app systems are expected to be down June 7th until June 10th. You will still have access to your account via phone banking to check your balance and perform transfers, ATMs, and the ability to use credit/debit cards. As always, help will be available during business hours via phone or in person at a branch.

May 20, 2024

QuickBook & Quicken Users

There are steps needed to ensure that your Quicken and QuickBooks software will work with the new Digital Banking platform. You will need to take action both before and after the upgrade to ensure that you data transfers smoothly to the upgraded Digital Banking platform.

On or Before Thursday, June 6, 2024

- Some preparation steps will need to be completed before Online Banking becomes unavailable Friday June 7th. You will need to back up your QuickBook and Quicken data file and update the application if necessary. You will also need to complete a final transaction download before this date since transaction history might not be available after the upgrade.

- Once the new Digital Banking platform is live, you will need to complete the deactivation/reactivation of you online banking connection to ensure that you get your current Quicken or QuickBooks accounts set up with the new connection.

Keep in mind that there will be no data aggregation for the first 5 to 7 days within the Digital Banking platform once live.

For more information, visit our QuickBooks, Quicken, & Mint Conversion Help Page.

May 2, 2024

Have a Joint Member on Your Account?

Joint account holders will have the ability to create personalized logins in the new digital banking system, enhancing their individual digital banking experience.

Unique Login Benefits:

- No shared username and password

- Unique digital experience for every member

- Access to individual credit score

- Separate Bill Pay transactions, & much more!

If your joint account holder would like a personalized digital experience in the new digital banking system, they will need to update their mobile number and email by following one of the simple steps below. This will ensure they receive their Multi-Factor Authentication (MFA) during enrollment.

- Send a secured message through online banking (include joint's name, mobile number, and email)

- Visit a branch

April 30, 2024

New Account Alerts with New Digital Banking Upgrade

Our current account alerts system will be discontinued and replaced by a new alert system with the new digital banking upgrade. Your current account alerts will not automatically migrate to the new system and some alerts will not be available.

- External Transfer

- Computer/Browser Registered

- Password Changed

- Secure Access Code Contact Information Changed

- Login ID Changed

- Forgot Password is Requested

- External Account Has Been Linked

- Invalid Password is Submitted

- Invalid Secure Access Code Submitted

- Login ID Disabled

- Login ID is Locked Out

- Secure Message Received

- New User Created

- Security Alert Preferences Changed

- Transfer Fails During Processing

- User Profile Updated

- Valid Password for Login ID Submitted

- Forgot Password Process Successfully Completed

- Valid Secure Access Code Submitted

- Daily Balance

- Large Withdrawal

- Direct Deposit Made

- Low Balance

- Loan Payment Due

April 16, 2024

CardSwap

Update your Austin Telco card information for your subscriptions.

CardSwap: The Solution for Updating Subscription Payments

In the digital age, keeping up with numerous subscriptions and automatic payments can be a hassle, especially when your card details change. Experience the ease of updating your card information in one centralized location with CardSwap. Streamline the process for a wide range of platforms from a list of service providers that is updated regularly.

Perks:

- Hassle-Free Replacement: Easily replace lost or expired card details on all your automatic payments, without the stress of missing a service.

- Simplified Management: Update your card information on your subscriptions and automatic payments with just a few clicks.

- One-Time Setup: Provide your login details for each service just once, and let CardSwap handle the rest, securely and efficiently. No need to visit each site individually.

April 2, 2024

Instant Pay

Transfer money securely to anyone, including nonmembers.

Instant Pay: Instant Money Transfers Simplified

Our Person-to-Person Payment service is redefining the way you pay your peers with our latest offering in the digital payment scene. Whether you’re splitting a dinner bill, sending a gift, or just helping out a friend, our Person-to-Person Payment service ensures that your money reaches its destination instantly.

Perks:

- Unified Payment Platform: Eliminate the need for multiple apps like Cash App, Zelle, or Venmo. Instant Pay is your single solution for all Person-to-Person transactions.

- Immediate Transfers: Experience the speed of instant transactions.

- Exclusively Person-to-Person: Designed for sending money to peers, ensuring a focused and optimized user experience.

- User-Centric Focused: Send money and let the receiver decide where to accept it, whether it’s Venmo, PayPal, or their Checking Account.

March 26,2024

Our Bill Pay Service Is Being Upgraded

Soon you will have access to an easier, faster, and more convenient way to pay bills. That's because all member accounts that use Bill Pay will be automatically upgraded free of charge during the launch of the new Digital Banking platform.

Prior to the Upgrade

-

If you use our Bill Pay Service, print out or save your payment history for your records and to verify your scheduled payment information after the upgrade.

After the Automatic Upgrade

-

Verify your payee names, addresses, and account numbers are correct. This will help avoid disruptions to your scheduled payments.

-

Set up new eBills for your payees. With eBill, you can view, pay, and track bills online.

We're Here to Help

If you have any questions regarding this upgrade, please contact us on our toll free number during regular business hours at 800-252-1310 or email us at techsupport@atfcu.org. Thank you for choosing Austin Telco FCU for your financial needs. We're excited to serve you even better with our upgraded Bill Pay service.

March 14, 2024

ClickSWITCH

Transition your recurring payments and direct deposit to an Austin Telco account with ease.

ClickSWITCH: Streamlining Your Financial Transitions with Ease

Managing direct deposit information can be a complex task, especially when transitioning between banks or jobs. ClickSWITCH is an innovative online banking tool designed to simplify this process, ensuring a seamless and efficient management of your direct deposits.

Perks:

- Time-Saving Convenience: Update all your direct deposit information in one centralized place, at one time.

- Ease for New Account Holders: Makes the transition to a new bank account smooth and hassle-free, especially for updating direct deposit and automatic ACH details.

- Simplified Job Changes: Changing jobs? Set up your direct deposit easily in one location.

March 8, 2024

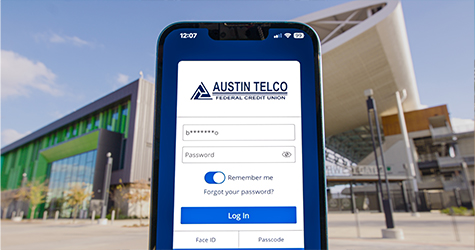

Retrieve and Switch to a Username - New Digital Banking Coming Spring 2024

To enhance security, there are important changes to come with logging in to our new digital banking platform. To ensure a seamless switch to the new platform, you will need to retrieve and switch to using your username instead of your member ID or account number to access online banking.

The upcoming transition to our new digital banking system will no longer support logging in with your member ID or account number. Along with the update, joint account holders will have the ability to create their own unique login for a personalized digital experience. While you're in your account, double check your contact information as well to ensure everything is up to date.

February 27, 2024

Account Consolidation

Connect and manage all your ATFCU personal accounts, including joint accounts, in one central location.

Consolidate Your Accounts: All-in-One Platform, Simplify Your Finances with The Power of One

Experience seamless management of your ATFCU financial accounts with our All-in-One platform. This streamlined solution offers a unified view of all your ATFCU accounts, including joint accounts, simplifying how you monitor your finances from a single location. Additionally, it allows for the integration of external accounts, enabling comprehensive monitoring through our Digital Banking platform.

Perks:

- Time-Saving Centralization: Access all your ATFCU accounts with a single sign-on, saving you valuable time and effort.

- Comprehensive Financial Overview: Get a complete picture of your balances in one place.

- Informed Financial Decisions: With all your financial information at your fingertips, make more informed decisions about your money.

- Enhanced Monitoring: Keep a close eye on your financial health, track spending patterns, and spot potential issues early.

February 14, 2024

Financial Tools

View your credit score and track your financial objectives.

SavvyMoney & Setting Goals: Empower Your Financial Future

Experience the ease of mastering your credit scores and making informed financial decisions with our financial tools SavvyMoney and setting goals. SavvyMoney provides the convenience of real-time access to your credit score, paired with financial education content. But it's not just about monitoring your financial health — it's about enhancing your financial well-being with your personal financial goals you can set.

Perks:

- Instant Access: View your credit score and credit report anytime, anywhere, at no cost with SavvyMoney.

- Educational Resources: Benefit from a library of content through SavvyMoney, designed to enhance your financial literacy.

- Smart Financial Management: SavvyMoney is your partner in managing your credit effectively, helping you make informed decisions and setting up financial goals.

- Real-Time Updates: Stay informed with up-to-date information on your credit status, aiding in quick decision-making and financial planning.

February 1, 2024

Experience the Power of One

One Login. One Click. One Experience. Exciting upgrades to our Online and Mobile Banking are on the way.

Over the next few weeks, we will highlight top features coming to the new digital banking platform, so be sure to follow along on Facebook, Instagram, or keep visiting this page to learn more about the convenience of handling all of your banking needs through one digital banking experience.

Curious for what's coming?

You Spoke, We Listened! New Digital Banking Platform Coming Spring 2024

Get ready for a new banking experience with Austin Telco Federal Credit Union. Our upcoming Digital Banking Platform is tailored to meet your needs with innovative features that enhance convenience, security, and financial management. The new platform will have a new modern look and features like:

- Update Subscription Payments: Update your Austin Telco card information for your subscriptions.

- New Financial Tools: View your credit score and track your financial objectives.

- Peer-to-Peer Money Transfer Solution: Transfer money securely to anyone, including nonmembers.

- Payment & Deposit Switch: Transition your recurring payments and direct deposits to an Austin Telco account with ease.

- Account Management and Consolidation: Connect and manage all of your external accounts from other financial institutions and organize them in one central location.

Each member will have a unique login to allow a tailored experience on the platform. Please ensure all your contact information is up to date for a seamless transition.

October 25, 2023

Austin Telco Federal Credit Union will be upgrading digital banking in spring 2024. We're excited to share details about the new features and improvements to mobile and desktop banking in the coming months. To prepare for this update:

- If you use your account number to log in to online or mobile banking, change to a username. This is a best practice for online security and will be a requirement for our new system. From the login screen, select "Retrieve Username" to look up your username.

- Update your contact information.

- Online Banking: Go to “Settings” (gear icon on the top right side) in the menu and then “Change Contact Information” to update your phone and email address

- Visit a branch

- Call 512-302-5555 during regular business hours

- Send a secure message