(2).gif)

Experience the Power of One in Online Banking

One Login. One Click. One Experience.

Austin Telco's Digital Banking Platform is your all-in-one solution for seamless financial management. Designed to simplify your online banking experience, our platform provides comprehensive access to your accounts and financial tools with a single login. Whether you're managing your credit score, consolidating accounts, or making instant payments, our innovative features ensure everything you need is just a click away.

Online Banking Highlighted Features

Instant Pay

Our Person-to-Person Payment service is redefining the way you pay your peers with our latest offering in the digital payment scene.

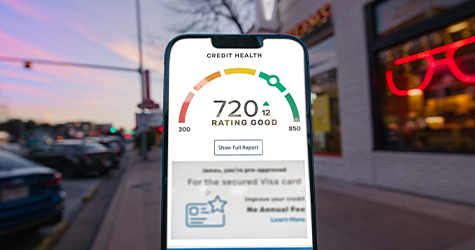

Credit Score by SavvyMoney

With one powerful tool, you can access your credit score, comprehensive credit report, real-time credit monitoring, and invaluable financial tips and education.

Financial Tools

Managing your finances shouldn't be difficult. With our comprehensive financial tools, you can monitor and manage all your financial accounts.

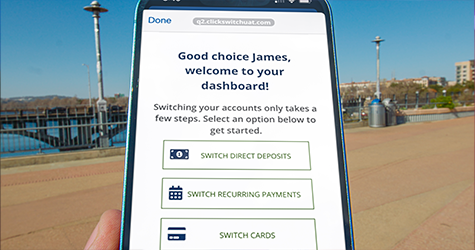

ClickSWITCH

Managing direct deposit information can be a complex task, especially when transitioning between banks or jobs. That's why there's ClickSWITCH.

Enroll in Digital Banking

Not enrolled in Digital Banking? It's easy and comes with the benefits listed here and more! Get enrolled today or become a member of ATFCU.

Bill Pay | Account Alerts | Statements & Tax Documents | Quicken, QuickBooks, and Mint | Mobile Banking

Digital Banking is a secure and convenient way to manage all your accounts 24/7. The security of your account is very important to Austin Telco, so we leverage the latest internet technology to help keep your financial information safe.

With Digital Online Banking, You Can:

- Send and receive secure messages.

- Transfer funds between your accounts, Austin Telco loan accounts, or to an external account.

- Pay bills online with Bill Pay.

- Receive free Account Alerts for low balances, direct deposit, and much more.

- View and download your Online Statements, tax forms, and cleared checks.

- Download transaction information into Quicken or other personal financial software.

- Activate or deactivate your Visa Debit or Credit Card.

- Access to our free financial management and Credit Score tools.

- Custom dashboard where you can choose which of your accounts are visible.

- And more.

Security in Digital Banking

Austin Telco employs proven practices to ensure the security of all digital online banking services. Keeping financial information secure and confidential is a top priority. Encryption technologies and multiple layers of security, including security questions and codes, are used to verify account holder identity and prevent unauthorized access.

Apple Watch®

Monitor your balances and transactions directly from your Apple Watch*!

This convenient feature is available to all members with an Apple Watch running WatchOS 9 or later, with limited functionality for WatchOS 8 users.

Here’s how to get started:

- Download the ATFCU Watch App

Make sure the ATFCU app is installed on your Apple Watch. - Enable Apple Watch Enrollment

Log into the mobile app on your iPhone, go to Settings, and select Apple Watch Enrollment to activate the feature.

Once you’re set up, you’ll be able to:

- View the first 10 account balances (as listed on your account summary page).

- Check the 10 most recent transactions for each of these accounts.

Stay Up-to-Date with Your Balances and Transactions:

- Balances refresh each time you launch the app.

- To refresh manually, press firmly on the watch face and tap "Refresh."

- Transaction details update automatically when you select an account balance.

With your finances just a glance away, managing your money has never been easier!

*Mobile and Digital banking services are not affiliated with, sponsored, or endorsed by Apple. Apple Watch is a trademark of Apple Inc., registered in the US and other countries.

Online Banking Bill Pay

Austin Telco's Bill Pay service offers the convenience of paying all your bills from one site. You can add payees and schedule one-time or recurring payments.

Key Member Benefits

- Easy scheduling for payments

- Add, edit, or delete payees

- Access to history and pending transactions

- Check images available for payments by check

Account Alerts

Stay connected with your Austin Telco FCU accounts by setting up customizable Account Alerts. Receive real-time updates on important account activities, from large withdrawals to low balances and security changes. Customize your notifications to ensure you're always in the know.

Online Statement & Tax Documents

Access your Digital Statements online anytime, anywhere. Stored for up to two years, these statements safeguard your financial privacy and help protect you from identity fraud. You can submit a request if you need information from further back. To view your statements, log in to Digital Banking and select 'Services' and click on the 'eStatements' tile.

For more information about Online Statements or Digital Banking, please call 512-302-5555 or visit one of our Austin Metro Locations.

For more information on privacy policy.

Quicken, QuickBooks, and Mint

Connect your Austin Telco FCU account to Quicken, QuickBooks, or Mint for seamless financial management. Follow our simple instructions to link your accounts and enhance your budgeting and spending tracking today.

Mobile Banking, Online Banking Made Easy

Our mobile app provides easy access to your account wherever your iPhone or Android device goes, offering a seamless experience with our Digital Banking platform. Use the same login credentials for both mobile and online banking, ensuring a unified and hassle-free experience. With our Mobile Banking, you can enjoy additional features like mobile deposit, push notifications, and biometric logins for enhanced convenience and security.

Key Features

- Bill Pay: Manage and pay your bills directly from the app.

- Mobile Deposit: Deposit checks easily using your device’s camera.

- Card Center: Access and manage your debit and credit cards.

- Find a Location: Locate ATFCU branches and ATMs near you.

- Apply for a Loan: Submit loan applications on the go.

- Send a Secure Message: Communicate securely with our customer service.

- Transfer Funds: Move money between your accounts effortlessly.

- Biometric Login: Use fingerprint or facial recognition for quick and secure access.

How to Get Started

- Enroll Online: Enroll to access the Digital Banking platform.

- Get the App: Download the app from the Apple App Store or Google Play Store.

- Log in to Your Account: Digital Banking and the Mobile App use the same credentials, all you need to do is log in.

Get the ATFCU App

Note: Cellular data access and text messaging are necessary to use the Mobile Banking service. Check with your wireless carrier for any possible fees that may apply. ATFCU Mobile Banking is a service only available to Digital Banking users.